- This topic has 5 replies, 3 voices, and was last updated 7 hours, 52 minutes ago by

Java.

-

AuthorPosts

-

-

February 4, 2026 at 5:43 pm #9608

-

February 4, 2026 at 8:32 pm #9622

RWC

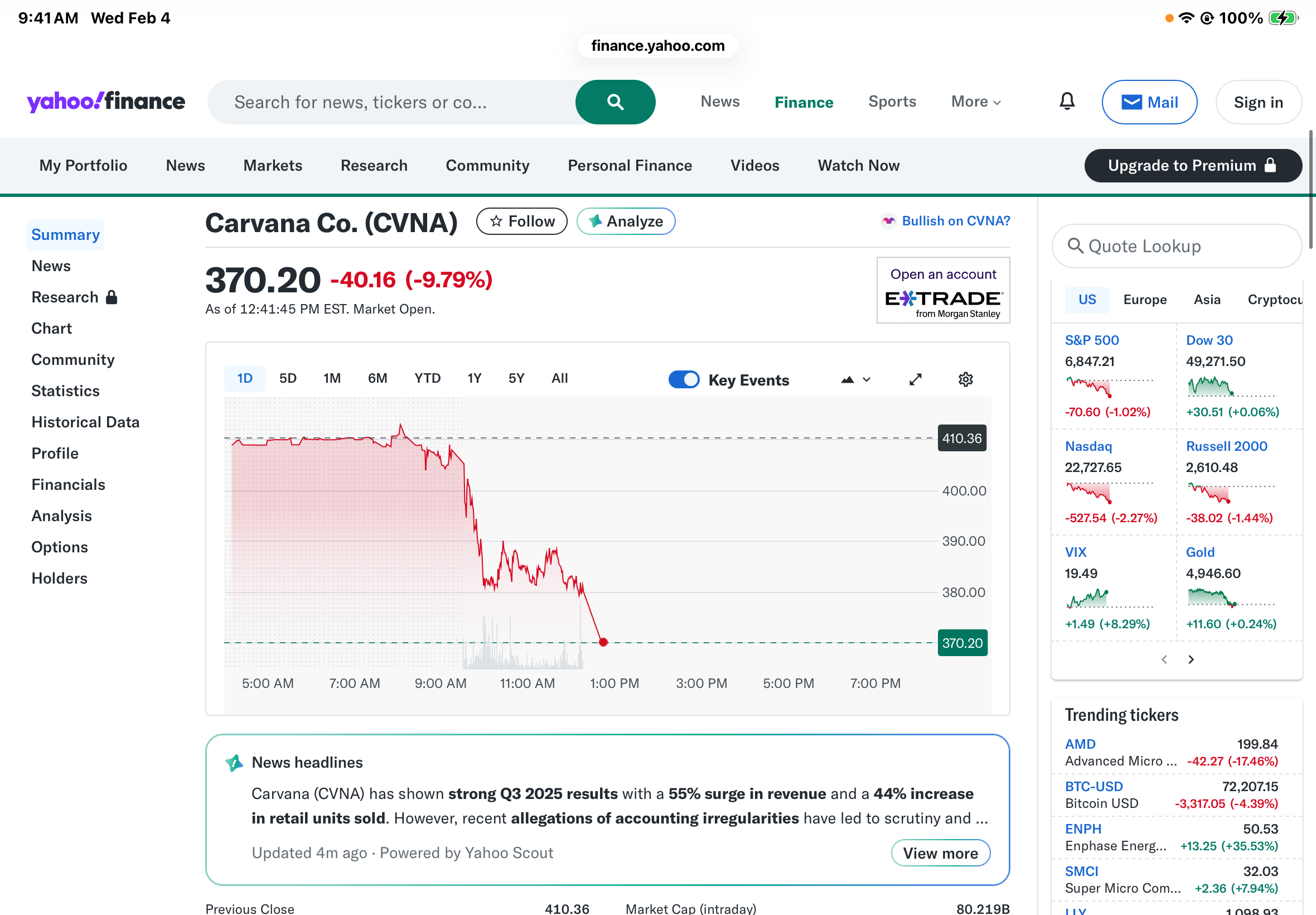

ParticipantWow, have to give him credit shorting CVNA, and buying TQQQ way back when it was pretty cheap. Nice move.

Might not be a bad idea to short some of these tech stocks the way they are getting slaughtered.

-

February 5, 2026 at 6:40 am #9644

BigBalls

ParticipantYeah, This is a good one to short even now. An SEC inquiry into their accounting practices will send it into a death spiral. I sold some NVDA and PLTR yesterday. I’m still in but I gotta reduce my exposure with tech stocks. The risk is growing in that sector.

Don’t hear the Bitcoin Boys talking much right about now. Huge problems brewing there.-

This reply was modified 1 day, 18 hours ago by

BigBalls.

-

This reply was modified 1 day, 18 hours ago by

-

-

February 6, 2026 at 7:21 am #9684

Java

KeymasterI wish. I am so pissed. First, I had calls and was forced to execute. Sell at $406 and then is hit the accelerator. Schwab then freaked out and make me buy almost all of it back or they were going to force me to sell stuff DICKS. I had 40,000 shares shorted.

I now have 9,000 because of those wankers. And wasn’t even supposed to execute. They allowed it to happen AFTER closing bell. Thats another story. Wanted to sue them. Cost me about a million.

So yes, now that it’s under $406. I bought 1,000 shares at $375 and it bounced back to $390 today but I think it’s short lived. I am hoping this is the beginning of the end. I will buy another 1,000 at 360, then 350 and on the way down. I was hoping to hold onto all 10,000 shares to $200 and pocket$2million to make up for the mil i lost and make another just to middle finger them.

At this point I just want to get out near as close to even as I can and get back to selling calls using my formula and making $5k-$10K a week.

I have a bunch of calls on it. 300 at $465 2/20. 200 Was 300 but Schwab peed their pants again, at $520 on 2/20 And 300 at $520 on 2/27. All those fall as they should and the good guys will net about $340,000 but this has been a really bumpy ride. Like not celebrating.

I hope Carvana dies a fast and painful death and the owner and son rot in hell

-

February 6, 2026 at 4:46 pm #9687

BigBalls

ParticipantMarket is roaring back today and pulling Carvana with it. Not sure if it’s a dead cat bounce for Carvana. SEC needs to look into these guys.

A guy I know sued Schwab for something similar, never heard if he settled, won or lost.Panic sellers from yesterday are getting punished today,

-

February 6, 2026 at 5:02 pm #9688

Java

KeymasterSec opened an investigation in June. Allegedly more after the report this January. Those take 18-24 months. Meanwhile attorneys are gathering investors for class action suits. Can’t believe anyone is supporting the stock

from what I’ve read now that they are in the sp 500 all the funds and Institutions have to own them. And so many people shorted them with calls like mine that as it goes up they had to execute and now they hold short shares and get out. Buy out every time it drops. Creating artificial floors.

also because of the shorts borrowing shares. And also the institutions and so much of the company held closely ther aren’t that many shares out for trade. Creating a scarcity effect.

in other words. All of the wrong reasons for the stock to be rising. So it would not appear the market itself is going to correct this inequity. What’s going to have to happen is that regulatory powers or suits are going tonhave to cause a suspension in trading or get them kicked outbid the sp 500. And that may take awhile. Meanwhile shorts like me get killed and I’m not eligible for those lawsuits I don’t think. I’m not technically a shareholder. Investor. I just sold calls against it and shorted it. They’d contend I’m part of the problem.

so today for example. Schwab wants $10 million from me. Well they aren’t going to get it. I’ll just buy back one of the calls and it will fall back in line.

the whole thing is more entertaining than I want it to be

oh here’s a twist. Expecting government regulators to make things right? Guess who is in bed with Carvana. ??? Not sure how. But Dan Quayle. Remember him? So I am guessing he is either there to keep the feds off their back or he still has friends in high places. And probably can run interference with his own party.

Wall street man. You think you have big money and you run into this. If I had about $20-$40 more million and about 2 years of patience? I bet I could make $100 million off this Carvana mess. As it is. I’m kinda just hoping to get my money back and move on. Sad. As you know. I’ve been on this thing for years

-

-

-

AuthorPosts

- You must be logged in to reply to this topic.